Direct vs. Indirect Cash Flow Statements

Most founders understand the Income Statement (Profit and Loss) and Balance Sheet, but the indirect Cash Flow statement, as taught in classes, can be a mystery. And in a SAAS business, another cash report, the direct cash flow statement, is the best indication of the health of your startup.

Indirect Cash Flow Statement

The indirect cash flow statement bridges the income statement to the balance sheet. Net Income is added to changes in the business’s assets, liabilities, capital, and financing to determine ending cash. While accurate and more straightforward to create for larger companies, this methodology poorly explains what happens within the company. Early-stage companies that maintain their financial statements on a cash basis can use the income statement as a close guide to cash, but more complex businesses need a better understanding of their cash.

Direct Cash Flow Statement

Every forecast should have the indirect Cash Flow statement described above but should also have a direct Cash Flow statement showing sources and uses of cash. For a typical SAAS business, the cash sources will be new and recurring clients. If billings are done annually, the forecast will need to account for the sizeable annual nature of these billings and assume customer churn. On the cash outflow side, payroll usually is the largest cash outflow each month, with capital expenses or rent as the next largest.

Clarity of Cash Flows

A direct Cash Flow statement, in both the short and long term, clearly highlights where the business generates and uses cash. It also highlights potential cash issues in the future due to the timing of collections or payments, enabling the finance team to address any cash shortfalls proactively. A deeper financial understanding and accurate forecast enable lenders to evaluate the business better when providing short-term loans and show investors the team has a sophisticated understanding of their business.

Example

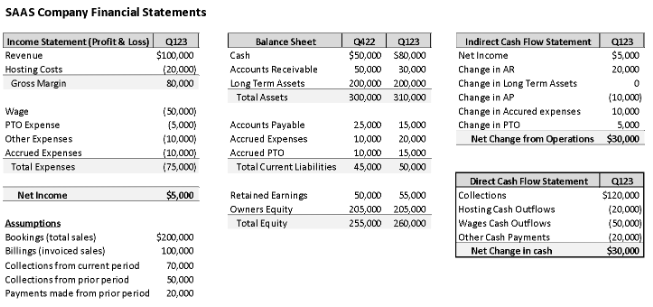

The simplified Financial Statements below show how a $100K quarterly SAAS revenue company with $5K in Net Income can generate $30K in Operational Cash. The Indirect Cash Flow Statement shows that the company reduced Accounts Receivable by collecting $20K more than they billed and increased accrued expenses by $15K, impacting cash in future periods.

The Direct Cash Flow Statement represents a clearer picture of the business, which generated $120K in cash from collections and spent $80K in cash to run the business. As businesses become more sophisticated, they can split out cash from renewals versus new sales, outflows to various departments, and create forecasts of future cash flows to understand their sources and uses of cash better.

Final Thoughts

In conclusion, while founders grasp the Income Statement and Balance Sheet, the indirect Cash Flow statement often mystifies. The direct Cash Flow statement is pivotal for SAAS businesses, offering a clear, granular view of cash movements. It goes beyond being a bridge, providing vital insights into sources, uses, and potential future issues. For founders, lenders, and investors, integrating the direct Cash Flow statement is imperative, fostering deeper comprehension and strategic decision-making. Embrace this financial tool to fortify your startup’s resilience and navigate the dynamic landscape effectively.

Related

For companies going through an acquisition, adding a strategic CFO at any time can help both the process and the CEO, who is still actively running the business. In an…

>>In the bustling world of startups, where innovation and speed often take the spotlight, one critical aspect that should never be overlooked is the financial close process. Known commonly as…

>>In the dynamic landscape of early-stage business endeavors, meticulous documentation management is the key to unlocking a pathway to successful fundraising or acquisition. By refining their approach to record keeping,…

>>Software as a Service (SAAS) is a unique business model that requires a particular set of metrics to understand better if the business is thriving. Many different places on the…

>>Most founders understand the Income Statement (Profit and Loss) and Balance Sheet, but the indirect Cash Flow statement, as taught in classes, can be a mystery. And in a SAAS…

>>The budget versus actual statement is a crucial measuring device for the Financial Planning and Analysis (FP&A) team. The best-run teams create these reports monthly (and quarterly/annually), comparing actual vs.…

>>Contact Us

Let's challenge the default together